pay indiana state tax warrant

Also called a lien the warrant is a public record that allows the government to claim your personal property or assets to satisfy the unpaid taxes. Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxes you must contact them immediately to avoid a court appearance.

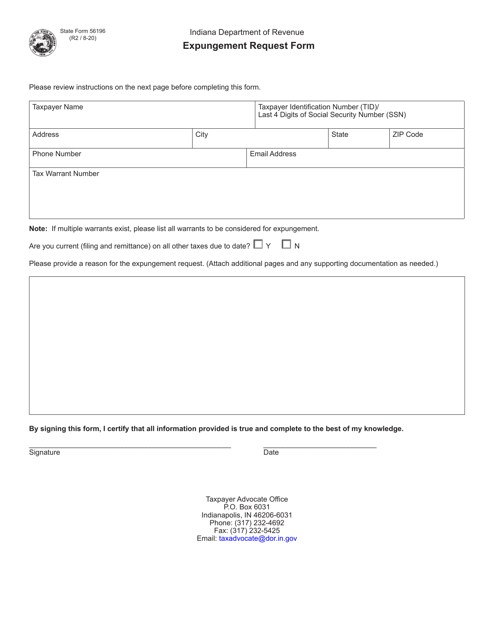

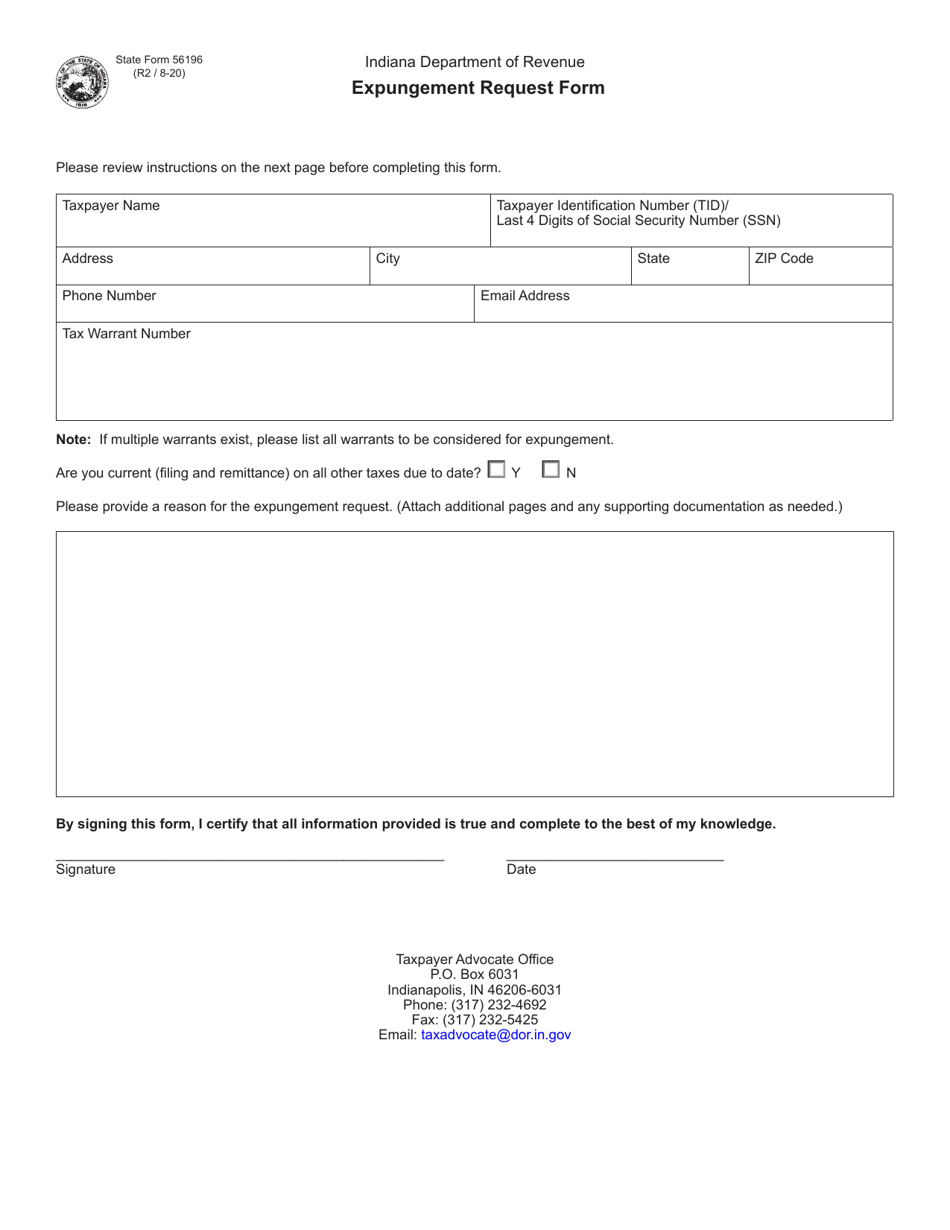

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

For more information call 317 232-5500.

. The Service this Tax Warrant Collection System provides is solely based in and reliant upon human and technical resources that are within the State of Indiana. If you have unpaid taxes and have received notification of a tax warrant heres what you need. Rates do increase however based on geography.

Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your s. If you wish to dispute the amount owed please contact the Indiana Department of Revenue directly in Indianapolis at 317 232-2165 or their Merrillville branch located at 1411 E 85th Ave Merrillville IN 46410 219 769-4267. Payments are accepted Monday-Friday 8 am.

Our information is updated as often as every ten minutes and is accessible 24 hours a day 7 days a week. INtax only remains available to file and pay the following tax obligations until July 8 2022. If you receive a written Tax Warrant follow these.

Payment may be made in person at the Spencer County Sheriffs Office or by mail. You can find information on how to pay your bill including payment plan options FAQs and more below. A tax warrant issued by the Indiana Department of Revenue will also add 10 percent to the unpaid tax as a collection fee.

A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. These should not be confused with county tax sales or a. Indiana Department of Revenue.

You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2165 or visiting wwwintaxpayingov. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax account s in one convenient location 247. To learn more about the EFT program please download and read the EFT Information Guide.

Unlike the federal income tax system rates do not vary based on income level. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources. The Sheriff of Porter County is authorized to collect taxes due to the State of Indiana.

430 pm EST. This Tax Warrant Collection System website is a passive website requiring You to input accurate information and take other actions to complete a Transaction. A Tax Warrant is not an arrest warrant.

Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number. Indiana Income Taxes.

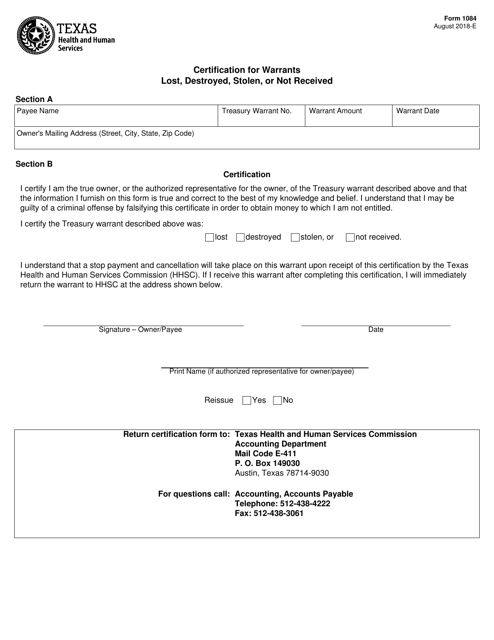

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to. Transfers warrants between your office and IDOR with one click.

The turnaround on tax warrants is quick as county courts can approve one in as little as 20 days after the initial demand is sent to the taxpayer. When you receive a tax bill you have several options. EFT allows our business customers to quickly and securely pay their taxes.

If you have specific questions about a bill call our payment services team at 317 232-2240 Monday through Friday 800 am. We now have tax warrant data for the entire state of Indiana and this information can be searched from the Welcome Page or by clicking on the tax warrants tab. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. Automatically generate notifications for the taxpayers. Eliminates ALL data entry of tax warrant information.

Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. 1 First The Indiana Department of Revenue itself attempts to collect your Indiana back tax debt by sending you demands via US Mail. Built for Indiana Sheriffs.

Please arrange to pay by cashiers check money order or cash. Answer 1 of 2. To pay a tax warrant or dispute the accuracy of a record contact the indiana department of revenue last updated on fri mar 31 165927 edt 2017 the data or information provided is based on information obtained from indiana courts clerks recorders and department of revenue and is not to be considered or used as an official record.

Depending on the amount of tax you owe. Doxpop provides access to over current and historical tax warrants in Indiana counties. Tax Warrants are issued by written letter never by telephone.

There are three stages of collection of back Indiana taxes. No personal or business checks are accepted. While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience.

Call us at 518-457-5893 during regular business hours and speak with a representative to request we send proof your warrant has been paid in full or if you have other questions related to a tax warrant. About Doxpop Tax Warrants. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. You should also know the amount due. ELIMINATES PINK SHEETS from the IDOR.

Questions regarding your account may be forwarded to DOR at 317 232-2240. In the administration office unless sent through mail. You can set up a payment plan with the Indiana Department of Revenue by calling 317-232-2240 or visiting httpsintimedoringoveServices.

Allows for creation of payment plans for persons making payments. Tax Liabilities and Case Payments. Our service is available 24 hours a day 7 days a week from any location.

Instead this is a chance to make voluntary restitution for taxes owed. Be sure to enter your taxpayer ID number when prompted. March 18 2022 0013.

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

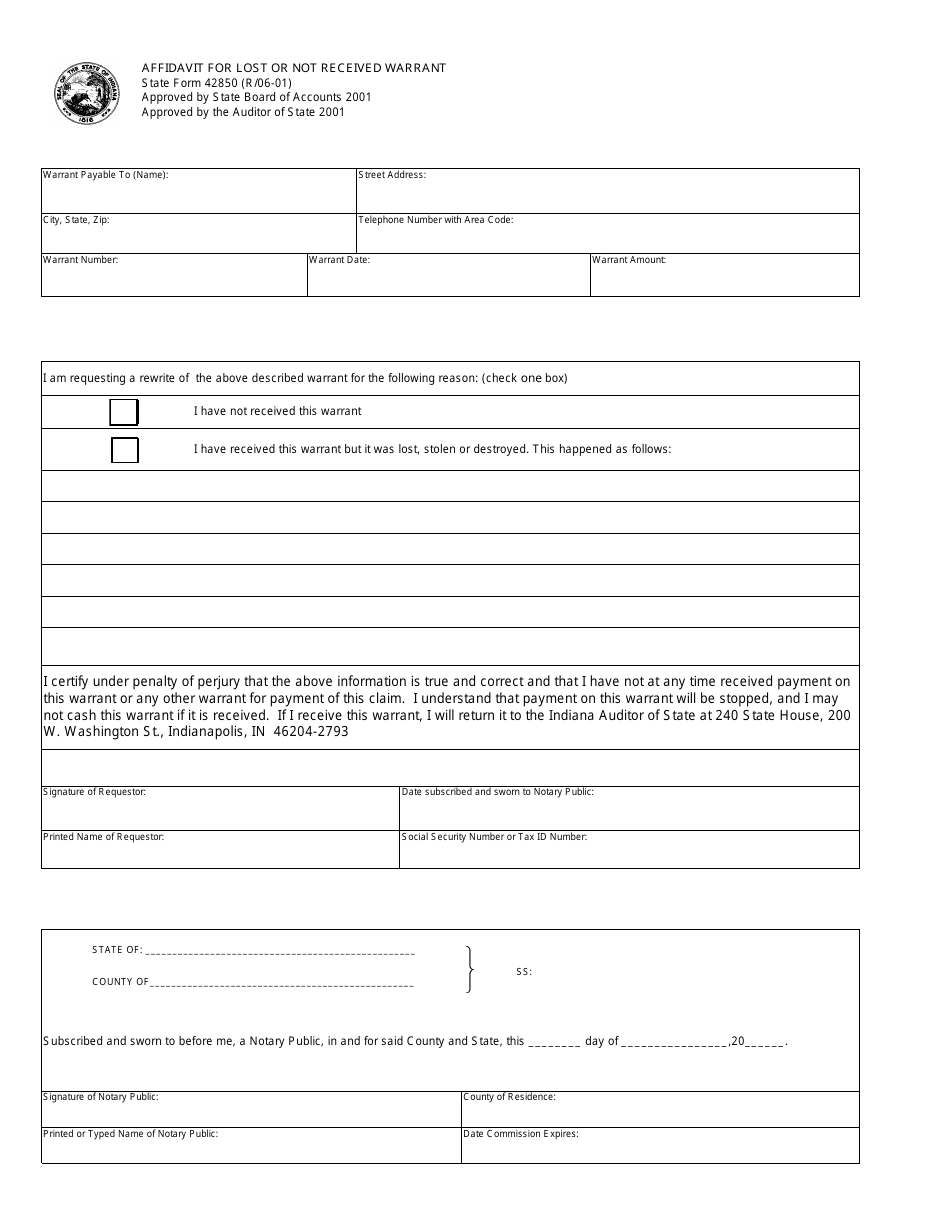

State Form 42850 Download Fillable Pdf Or Fill Online Affidavit For Lost Or Not Received Warrant 2001 Templateroller

State Form 56196 Download Fillable Pdf Or Fill Online Expungement Request Form Indiana Templateroller

Scam Alert Letter Being Sent That Threatens Property Seizure If Taxes Aren T Paid

Agency Announcement Indiana Dor Adds More Features To New Indiana Tax System

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Lsnjlaw What Happens After The Eviction Hearing

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Warrant Out For Your Arrest Top 5 Sites To Help You Tell If You Have A Warrant Juneau Empire

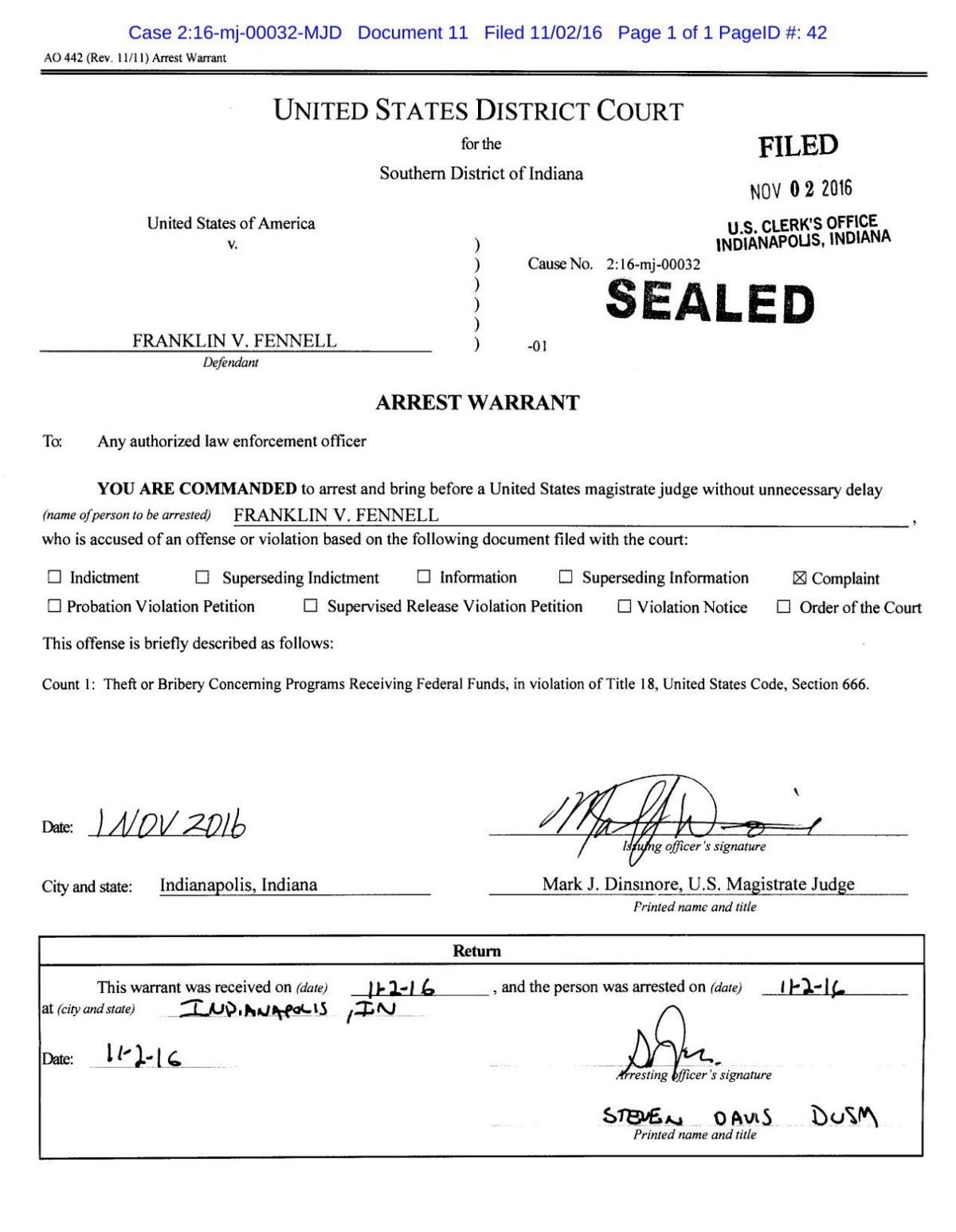

Franklin Fennell Arrest Warrant Tribstar Com

Lsnjlaw What Happens After The Eviction Hearing

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter